As we settle into the new year, the alcohol industry is seeing mixed results across different categories. While spirits demonstrated a solid improvement in January compared to previous trends, wine continues to struggle. This contrast highlights ongoing shifts in consumer behavior and distribution challenges within the industry.

Spirits Show Resilience

January brought mixed signs for the spirits sector, with volume down by -3.6% and revenue declining by -1.2%, a slight improvement from when revenue saw a 2.4% drop (December 2024). While these figures indicate an overall decline, they reflect an improvement compared to previous months.

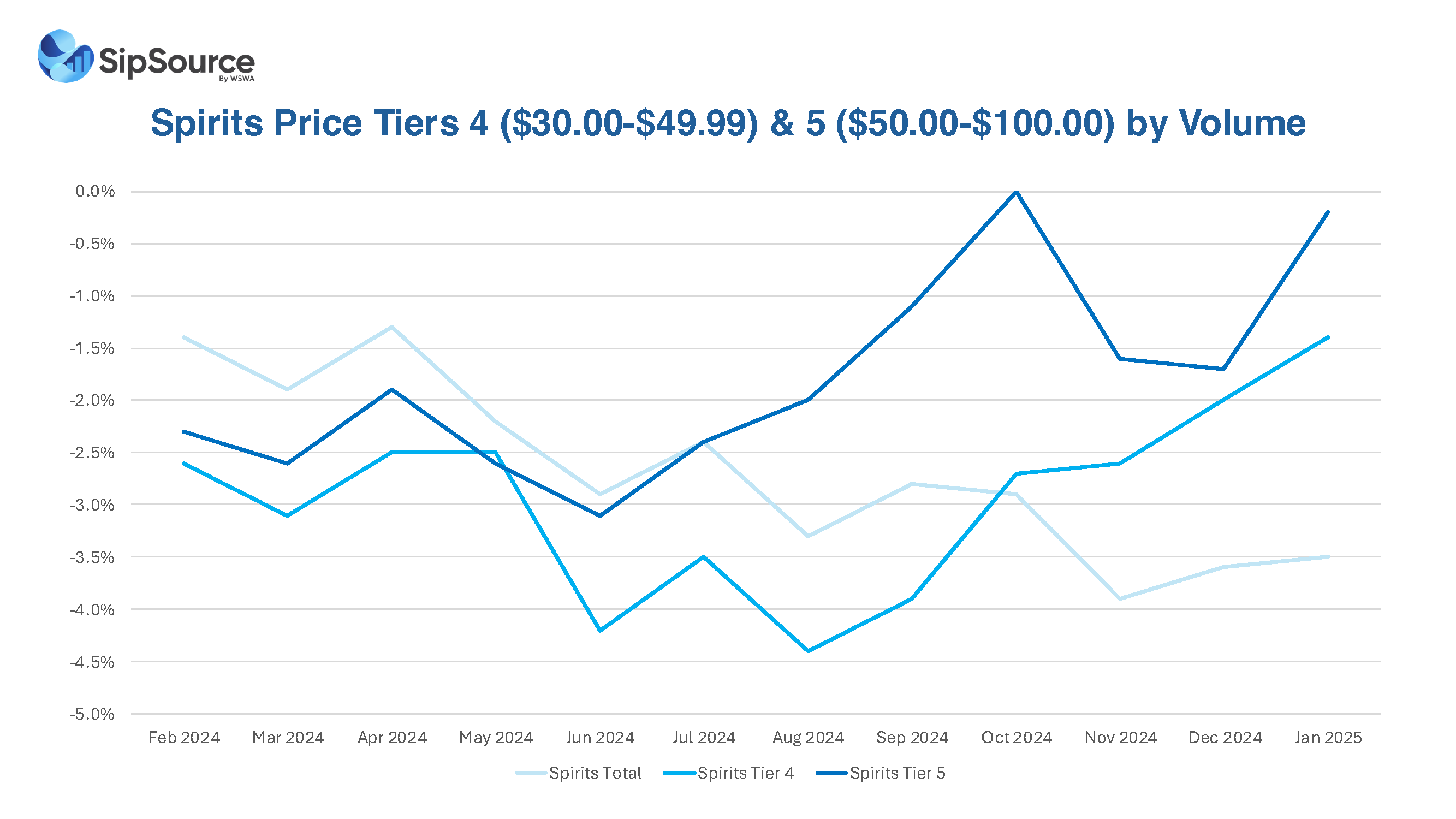

The narrowing revenue drop suggests that premiumization – consumers opting for higher-end products – is helping offset volume losses. This is evident when looking at Spirits Tier 4 & 5 priced between $30.00 - $99.99 that are outpacing the overall market. Consumers appear willing to spend more on quality spirits, signaling a potential area of focus for brands looking to maintain profitability in a challenging market.

Wine Faces Continued Weakness

In contrast, the wine category saw sharper declines, with volume dropping by -9.6% and revenue falling by -9.9% in January-ending data. This persistent softness suggests that wine is struggling to regain momentum in the post-holiday season. Factors such as changing consumer preferences, increased competition from ready-to-drink (RTD) beverages, and younger demographics gravitating toward other choices both within and outside beverage alcohol may be contributing to this downturn.

Distribution Challenges Persist

Another key concern is the continued decline in Points of Distribution (PODS), which measures the availability of products across retail and on-premise locations. Overall, PODS for spirits and wine combined fell by -4.4%, with spirits and wine excluding cocktails experiencing an even steeper decline of -5.1%. This contraction in distribution points underscores challenges in maintaining shelf space and presence in key outlets.

The reduction in PODS could be attributed to various factors, including shifting retailer strategies, the rise of alternative alcohol categories, and evolving consumer preferences. For brands, this emphasizes the need for strategic distribution efforts, strong partnerships with retailers, and innovative marketing to maintain visibility and accessibility in the marketplace.

Looking Ahead

Remaining comps in Q1 2025 (February and March) are favorable, but not without challenges. Spirits face remaining Q1 comps of -5.3% in volume and -5.8% in revenue, while wine Q1 comps are -9.6% in volume and -7.8% in revenue. Additionally, one less shipping day in Q1 2025 due to the 2024 Leap Year as well as a later Easter on April 20th may impact sales trends.

Volatile economic conditions, including tariffs, inflation, and employment uncertainty, will continue to influence consumer confidence and spending patterns. Retailers and on-premise operators are expected to prioritize cash flow, which may further pressure shelf space, particularly for wine, as spring resets take effect. PODS contraction is likely to persist, making promotional execution a key factor in navigating the market successfully.

As 2025 unfolds, monitoring these trends will be essential to navigating the evolving alcohol market successfully.