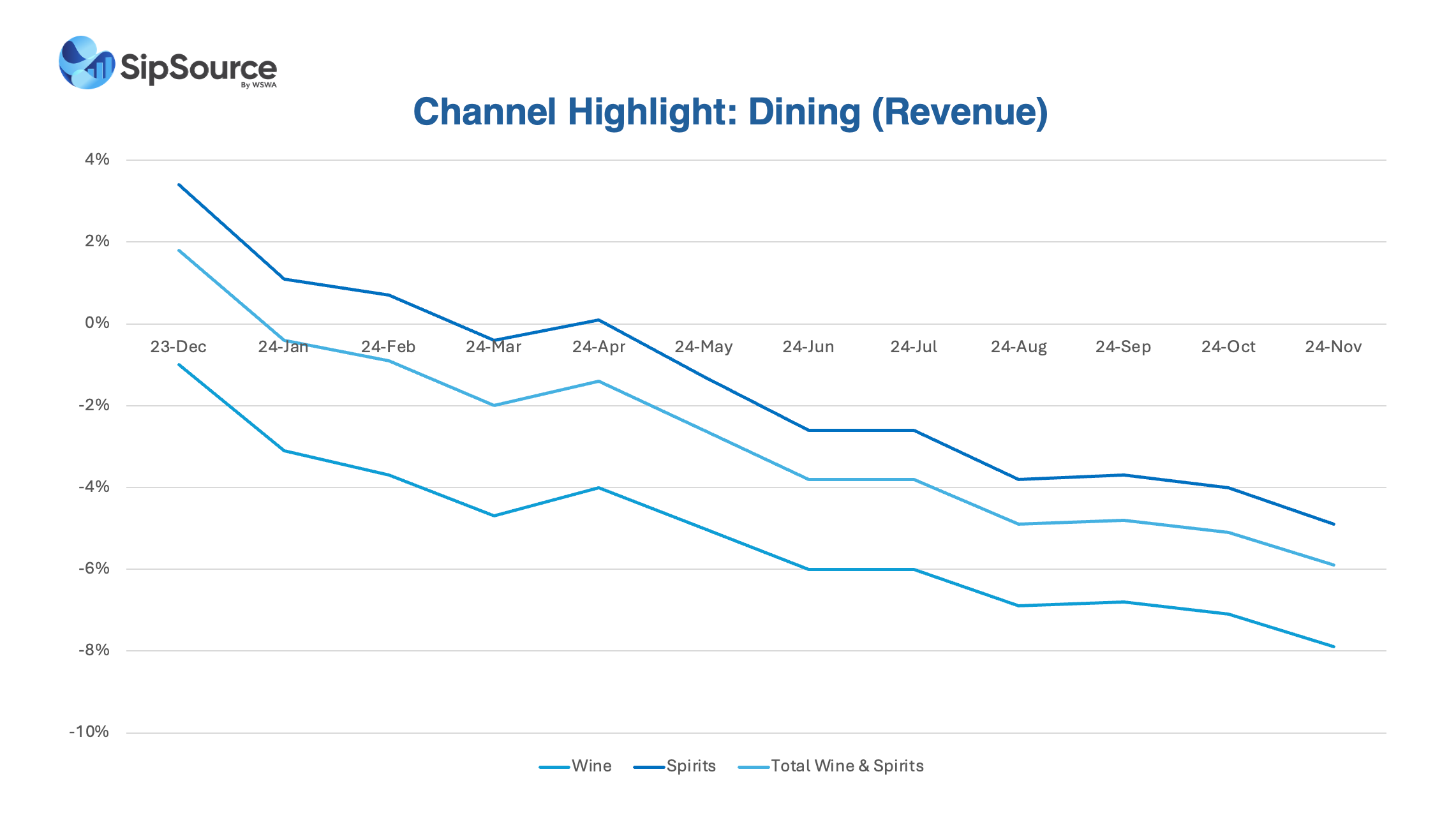

The big picture: This report analyzes November 2024 depletion data as WSWA’s SipSource continues its focus on key channels into 2025. After spotlighting the liquor channel in last month’s report for October 2024, this edition examines wine and spirits performance in the dining channel, using revenue metrics introduced earlier in the year.

By the numbers:

- Spirits: Over the past 12 months, dining channel revenue declined by 4.9%, aligning with overall on-premise trends. The dining channel accounts for 42.7% of on-premise revenue.

- Wine: Wine performed worse, dropping 7.9%, slightly underperforming the overall on-premise decline by 1.3%. Dining captured 55.6% of on-premise wine revenue but trailed the bar and nightclub channel growth by a point and a half, which holds a 15.0% share of on-premise wine sales.

- Regional performance: Both wine and spirits underperformed in the Pacific and Mountain regions compared to broader revenue trends.

Spirits Product Classes:

- Cocktails-Spirits: The only category to grow, gaining 9.7% with a 1.4% channel share.

- Declines: Irish Whiskey (-10.1%) and Brandy/Cognac (-17.0%) saw double-digit drops. Cordial/Liqueur/Specialty lost 1.1%, and US Whiskey declined 3.4%.

- Best-performing price tier: Tier 4 ($25.00-$49.99), dropping 3.8% while holding 38.7% of dining spirits revenue.

Wine Product Classes:

- Table Wine (White and Red): Representing 75% of revenue, combined declined 8.0%.

- Champagne/Sparkling: Held a 16.8% share, also declining 8.0%.

- Sparkling Tier 3 ($13.00-$17.99): The only price tier to post growth, with a 0.1% gain. Aggregated price tiers: Cocktails lost 5.1%, Sparkling dropped 8.0%, and Table fell 8.1%.

Why it matters: The dining channel continues to face significant challenges for wine and spirits. As consumers increasingly shift toward off-premise purchases and other alternatives, the sector is struggling to recover.

What’s next: Innovation is key for the dining industry to adapt to evolving consumer preferences. Exploring new strategies for engagement and sales will be crucial to revitalizing beverage offerings in this channel.