WASHINGTON, D.C., January 21, 2025 – In response to a potential tariff on Mexican-origin products by President Trump, Wine and Spirits Wholesalers of America (WSWA) today re-released the findings of a preliminary economic study conducted by John Dunham and Associates (JDA) in December 2024 that examined the impact of a potential 25% tariff on Mexican wine and spirits products.

As the new administration considers tariffs on imported goods, WSWA urges the United States Trade Representative (USTR) to consider that at a time when the combined wine and spirits marketplace has already seen a -5.5% volume decline in the last year, these proposed policies could drastically reshape the U.S. beverage alcohol industry and its broader economic landscape. Imported products account for 30–35% of our industry’s market, and iconic, single-origin, products like tequila can’t be replaced in flavor, tradition, or consumer demand by domestic products because there is no equivalency.

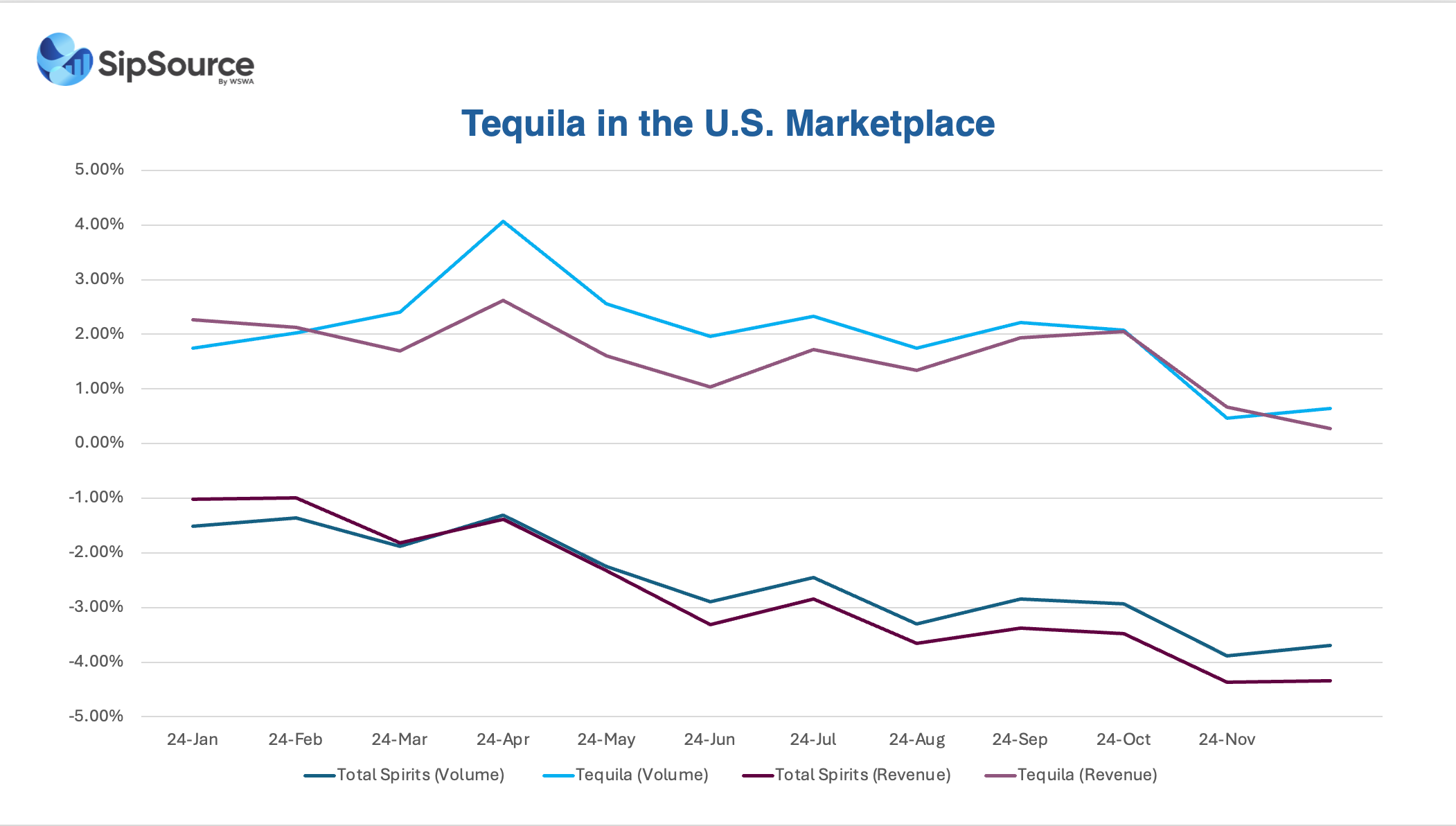

Mexican single-origin imported products, including tequila and mezcal, facing potential tariffs under the new administration are one of the only drivers of growth in the U.S. spirits marketplace. According to the latest available data from WSWA’s SipSource (December 2024), agave-based spirits represent 13% of the total U.S. beverage alcohol marketplace by volume and 22% by revenue.

Moreover, in the on-premise – or local restaurants, bars, entertainment venues, etc. – already hit hard by inflationary pressures – they outperform nearly every other category, making up 20% of the market by volume and 27% by revenue. It should also be recognized that in a recent Nielsen CGA's “Cocktail Sales Snapshot,” the Margarita (which has a tequila base) was the most ordered cocktail in U.S. bars and restaurants.

25% Tariff on Mexican Products | |

| Jobs Lost | 14,000 |

| Wages Lost | $774 million |

| Tax Revenue Lost | $1.3 billion |

| U.S. Economic Output Lost | $2.5 billion |

According to JDA’s economic analysis, a potential 25% tariff on Mexican wine and spirits products, including agave-based spirits, could endanger up to 14,000 American jobs, accounting for $774 million in wages, $1.3 million in lost tax revenue and $2.5 billion in lost U.S. economic output.

“[In 2019], the economy was strong, and consumers were not grappling with the inflationary pressures we see today. Although the tariffs were disruptive, we were able to adjust and absorb the impact across the industry to maintain market stability. However, the situation now is markedly different,” said WSWA Chairwoman and President of Opici Family Distributing Dina Opici. “Any new tariffs on wine and spirits in today’s economic climate would be extremely disruptive…The entire industry—from suppliers to importers to distributors to retailers—is under immense pressure, with little room to absorb or distribute the cost of additional tariffs. Passing these costs onto consumers would only exacerbate the already fragile state of the wine market, leading to further deterioration.”

“WSWA is committed to working with the new Administration to underscore the cost to our members, nearly all of which are family-owned companies,” said WSWA President and CEO Francis Creighton. “Due to the uniqueness of the U.S. alcohol three-tier system—the global standard for alcohol regulation and distribution—these tariffs will primarily impact American businesses and consumers,” he concluded.