Spirits and Wine Trends Stabilize in Negative Territory

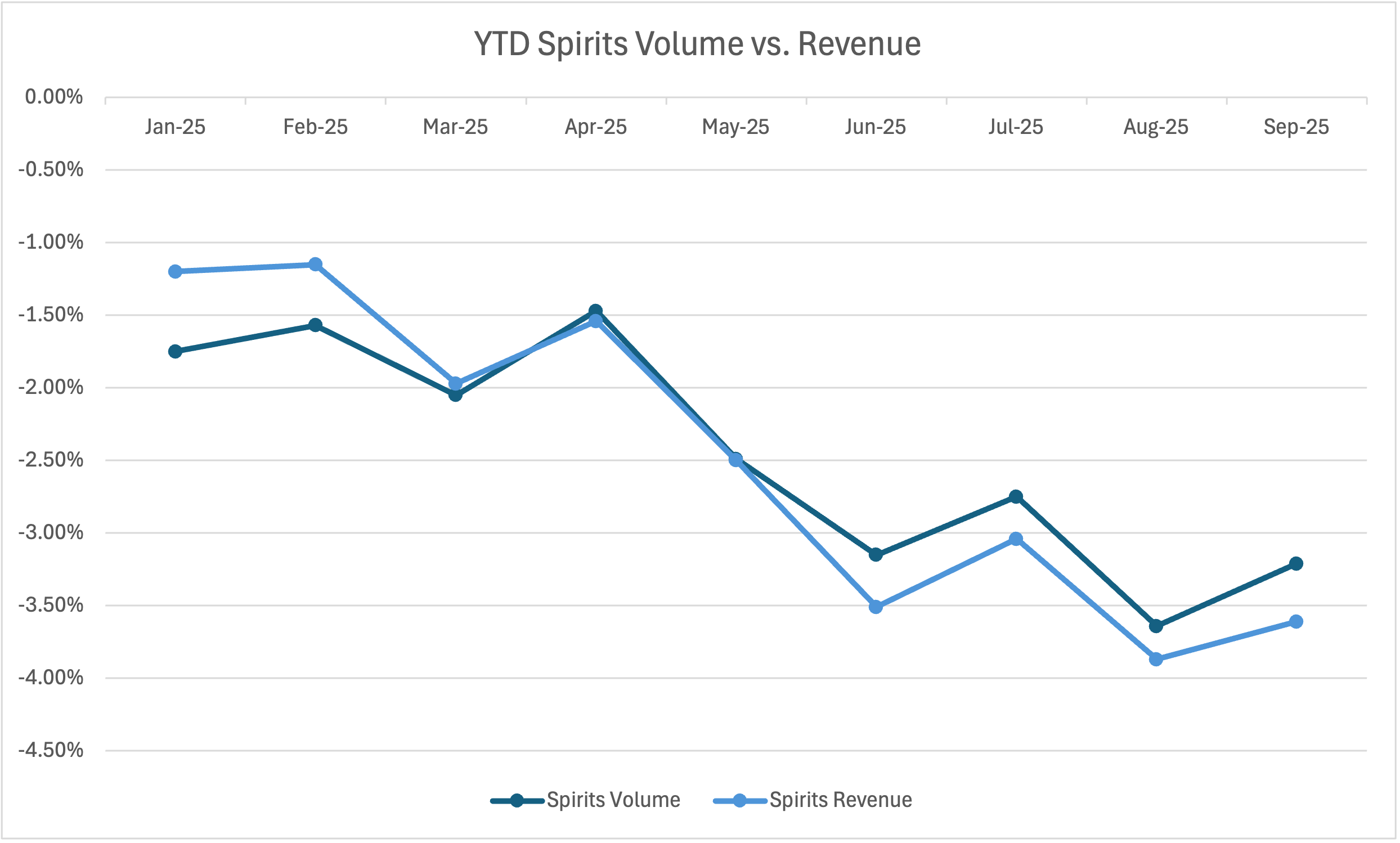

After 30 months of continued declines following an extraordinary and unsustainable growth rate of over +8%, spirits trends appear to be stabilizing in negative territory. Since March 2022, the decline has been steady after three years of remarkable growth. Comparing current data to June's shows spirits volume is now down -3.3% compared to -3.2% in June. Revenue trends show a similar gap: -3.7% currently versus -3.6% in June.

Wine trends have been more stable in the negative zone for a longer period. Wine volume is currently down -7.3%, slightly improved from -7.7% in June, with revenue at -5.8% versus June’s -5.6%. To reverse these declines, continued stabilization is key. Notably, despite the challenges, spirits volume remains positive over the last five years due to high growth rates in 2020–2022.

Premiumization Remains a Challenge for Spirits

Spirits volume is outperforming revenue by 40 basis points, indicating a lack of premiumization. One driver of this trend is the growth of Premixed Cocktails, which rank as the second-largest spirits category by volume but only ninth by revenue. Growth in Premixed Cocktails is slowing, ending September with +6.2% revenue growth. It remains to be seen whether consumers will choose more premium-priced spirits during the holidays.

What’s Next?

Happy holidays—hopefully! Economic factors continue to drive consumer behavior. Inflation has moderated, with September’s Consumer Price Index (CPI) at +2.4%. The CPI for Food is +2.3%, but the gap between “Food at Home” (+1.3%) and “Food Out of Home” (+3.9%) continues to pressure the on-premise channel. With consumer debt at an all-time high, spending is likely to remain constrained. Looking toward the end of 2024, we anticipate a challenging market with no significant turnaround in trends.

Happy Holidays!