WASHINGTON, D.C. 05/07/2024 – Wine & Spirits Wholesalers of America (WSWA)’s SipSource, the only source for verified wine and spirits distributor depletion data that covers sales to hundreds of thousands of retailers across the country, yesterday released the Q1 2024 SipSource Report. The quarterly report identifies continued losses for both wine and spirits, individual category trends, demographic data, and explores commercial and consumer behaviors that contributed to the market’s current state. The report focuses on data over a 12-month period (April 2023 - March 2024), predicts what consumer trends will bring for both the on- and off-premise throughout the rest of the year, and gives short- and long-term insight and understanding for the industry’s future.

The first quarter of 2024 ended in a lull, as March depletion performance dragged down the three-month total. March ending 12-month trends for Spirits were down -2.7% and -8.3% for Wine. The numbers for the latest 3-months (January - March 2024) are significantly softer with Spirits down -5.2% and Wine down -10.9%.

“As the calendar turns to spring, my thoughts always turn to baseball. Wine and Spirits categories are currently underperforming expectations and have started the year in a slump. Most categories and channels will likely break out of their slumps and significantly improve their performance, while others will continue to struggle the entire year,” said SipSource Analyst Dale Stratton.

On-Premise Spirits Depletions Peak at Pre-Pandemic Levels

On-premise depletion trends moderated in Q1, down -2.9% for combined wine and spirits with Spirits continuing to win in the on-premise down only -0.1%, while wine struggles linger, down -6.5%. Of note, while on-premise share of spirits depletions has now fully recovered, reaching pre-pandemic levels in March-ending data, recent trends in the on-premise are decelerating, with the latest data showing down -8.0% for combined wine and spirits – marking a potential peak in depletions.

“The cost of going out to dinner may have finally caught up with the average consumer,” says Stratton. “While the Consumer Price Index (CPI) in March was up +3.5% compared to +6.5% in December, continued inflationary pressures, raising gas prices, as well as the gap between the cost of food and beverage at-home vs. away-from-home is impacting consumer spending.”

Pacific Division Outlier as Geographic Trends Stabilize

From a geographical standpoint, all regions/divisions continue to lose momentum, but growth trends are largely consistent, with the one outlier being the Pacific Division, down -13.6% for combined wine and spirits depletions. The gap between the remaining geographies is only 250 basis points, with the South Atlantic states performing best, down -2.5%. Wine is the big driver of losses in the Pacific Division, down -18.7%, with Spirits down -8.1%.

On-Premise a Bright Spot for Spirits, Pre-Mixed Continues to Dominate

Despite the price for spirits away from home rising +5.0% in March compared to at home prices rising only +1.4%, Spirits in the on-premise have continued to show resilience and are down only -0.1% in the same period. A significant amount of this growth is driven by Premixed Cocktails, which are up +24.6%. The Recreation channel leads growth for Premixed Cocktails, up +34.9%, but all major channels are showing significant increases. Looking forward, it is going to be difficult for the on-premise to maintain strength for spirits as comps in the next quarter are strong, up +3.5%.

“Given the growth challenges identified in this report, it is even more critical to examine granular data points within SipSource to find spots of growth and opportunity – whether those be product segments, sub-channels, price tiers, or geographies,” said SipSource Analyst Danny Brager.

The Road Ahead

SipSource Analysts believe trends for spirits are going to get better in 2024 but are unlikely to get back to the growth rates seen in 2022. Trends for wine will stabilize and should show moderate improvement in the back half of the year. The trend gap is currently 570 basis points compared to 540 basis points in December and 530 basis points in April of 2023. We have also been tracking the trend gap between Spirits without Premixed Cocktails and Total Spirits. That gap has narrowed as the growth of Premixed Cocktails, while still strong, has moderated. Currently the trend gap is 150 basis points compared to 340 basis points in April of 2023.

“The month-to-month data is going to be bumpy going forward, mostly based on variations in the number of delivery days each month,” said Stratton. “It’s also important to note that wholesaler inventory levels remain at an all-time high which could impact shipments from suppliers.”

SipSource Forecasting Report Predicted This!

At WSWA’s Access LIVE held in early 2024, SipSource released the first spirits forecast in partnership with Kearney, VIP, and NIQ. The SipSource Forecasting Report is the only industry-level forecast for wine and spirits that uses real wholesaler depletions, NIQ retailer point of sale, and an AI-powered forecasting engine to give the most complete view of the spirits market.

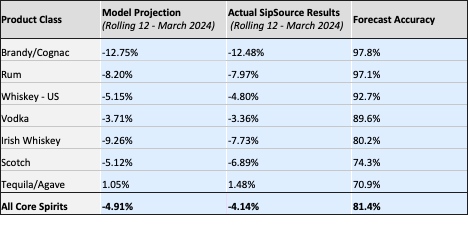

Looking back on Q1, the forecast proved to be highly accurate at predicting an unprecedented continuation of the declining growth trend across spirits product classes, predicting a -4.91% rolling 12 depletion growth rate in Q1 for All Core Spirits (excluding RTDs) vs the -4.14% that actually occurred. Results by product class can be found in Figure 1 below.

As a reminder, the most likely full year forecast for 2024 for All Core Spirits was -4.03% (with confidence intervals ranging from -4.93% to -3.08%). The SipSource team will continue to track the model’s performance throughout the year.

Figure 1: Q1 SipSource Forecasting Results – Change in 9L Depletions

To schedule a SipSource demo, email info@SipSource.com.