WASHINGTON D.C., Nov. 4, 2024– Wine & Spirits Wholesalers of America’s (WSWA) SipSource, the industry’s leading source for wine and spirits wholesaler depletion and consumption trends, announced today that its latest SipSource Forecast shows the spirits sector will face continued structural challenges for the remainder of 2024, the first half of 2025, and beyond.

“2025 is expected to be another challenging year for the spirits market,” said Michael Bilello, WSWA’s executive vice president of communications and marketing and director of SipSource. “Market participants should be planning now for continued headwinds,” he added.

The projections, based on models leveraging the most comprehensive data sources available in the spirits industry—including depletions from 19 WSWA member wholesalers, more than 10 macroeconomic indicators, and other data—are powered by artificial intelligence and machine learning. These models predict a continued industry decline, marking an unprecedented departure from pre-pandemic and COVID-era growth.

The same forecast, released in January, accurately predicted negative trends in the industry for the first half of 2024, with nearly 90% accuracy for all core spirits. The numbers established for the rest of 2024 and the first half of 2025 have undergone similar scrutiny through both quantitative and qualitative methods.

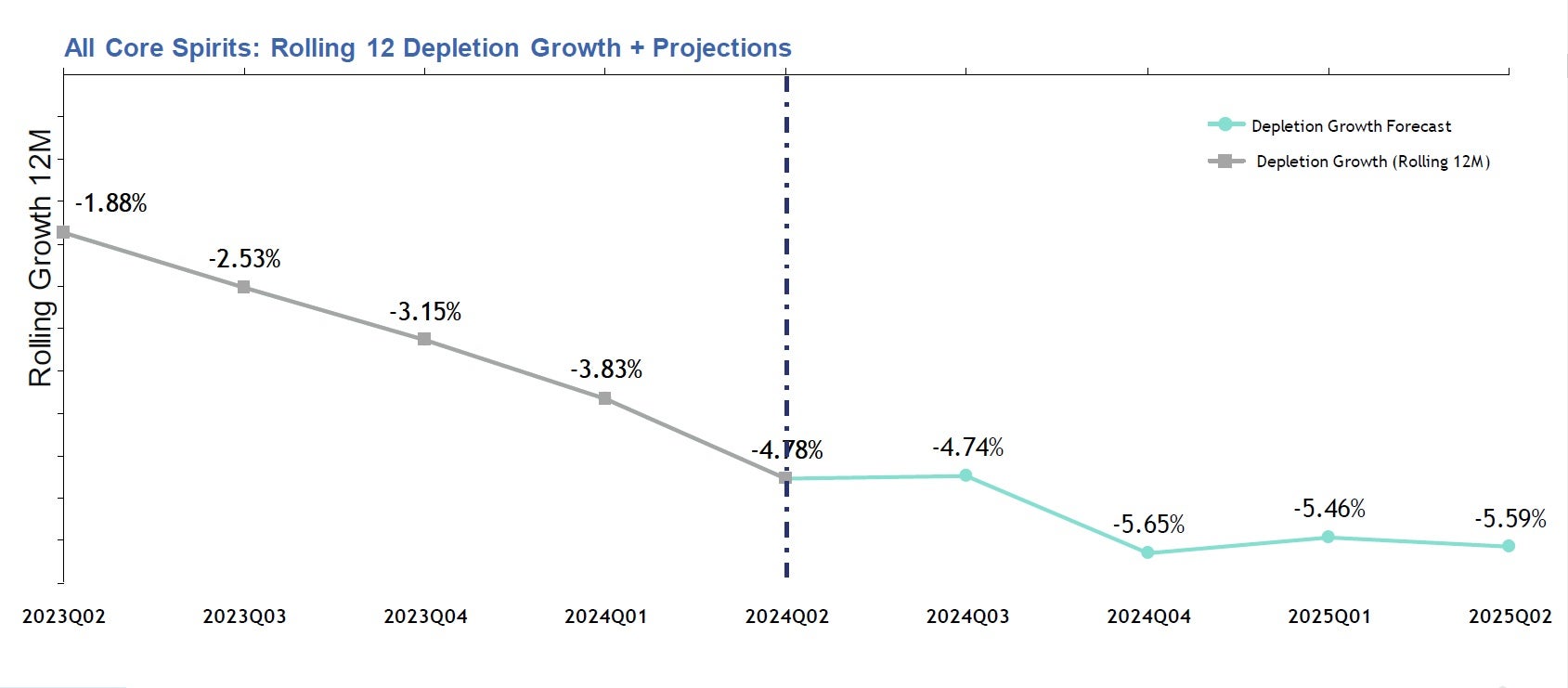

At the All Core Spirits level, the rolling 12-month depletion growth rate is expected to continue its decline—from -4.78% at the end of the second quarter of 2024 to -5.65% by year-end. The rolling 12-month growth rate is projected to stabilize around -5.59% in the first half of 2025.

Additionally, forecasts indicate a broad shift toward more "affordable luxury," specifically in the $17-24.99 and $25-49.99 price tiers 3 and 4, as consumers move away from the very highest-end spirits in favor of less expensive products across all categories.

"We have seen premiumization trends stall in key spirits categories, which have been ongoing for over a decade and peaked during the COVID era," said SipSource analyst Dale Stratton.

The SipSource Forecast also offers insight into individual product categories. For example, Vodka is expected to mirror the overall decline in Core Spirits, with a forecasted rolling 12-month growth rate of -5.15% in Q4 2024 and -4.42% in Q2 2025. American whiskey is projected to face a sharper downturn, with the decline expected to reach -6.82% by Q2 2025.

These forecasts reflect broader societal trends affecting the industry. "Regression to pre-pandemic consumption levels, broader economic challenges, the growing popularity of ready-to-drink cocktails, the emergence of substitutes like cannabis, and a generational shift in attitudes toward spirits and beverage alcohol in general (including social moderation) are all contributing to the prolonged downturn impacting the industry," said SipSource analyst Danny Brager.

Macroeconomic indicators such as inflation and money supply are not expected to significantly impact these forecasts. However, SipSource will continue to monitor policy changes in the next three to six months that could affect consumer behavior. This dynamic approach underscores the accuracy and flexibility of SipSource's forecasting models, which are continuously updated to reflect new data.

"While other predictions of recovery and economic anomalies have proven incorrect, SipSource provides unparalleled analysis and modeling capabilities. It remains an essential tool for staying ahead in this unpredictable market," concluded Bilello.

For more information on SipSource, please contact Michael.Bilello@wswa.org.

WSWA’s SipSource: The Leading Source for Wine & Spirits Market Trends

SipSource is the only provider of trusted, accurate wine and spirits insights powered by aggregated distributor depletion data. Representing over 60% of U.S. wholesale volume across 50 states, SipSource includes data from 150,000+ SKUs and 450,000+ outlets. This primary-source data, exclusively from WSWA’s family-owned distributors, is never shared with third-party providers. Built on detailed, single-product transactions between wholesalers and retailers, SipSource offers reliable historical trends and advanced forecasting to deliver unmatched industry visibility.